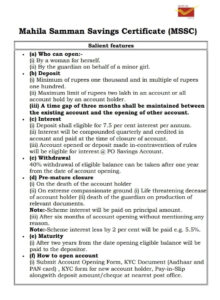

Mahila Samman Savings Certificate (MSSC) Account/Scheme Salient features:

(a) Who can open MSSC Scheme Account:-

(i) By a woman for herself.

(ii) By the guardian on behalf of a minor girl.

(b) Deposit in

Mahila Samman Savings Certificate (MSSC)

(i) Minimum of rupees one thousand and in multiple of rupees one hundred.

(ii) Maximum limit of rupees two lakh in an account or all account hold by an account holder.

(iii) A time gap of three months shall be maintained between the existing account and the opening of other account.

(c) Interest of

Mahila Samman Savings Certificate (MSSC)

(i) Deposit shall eligible for 7.5 per cent interest per annum.

(ii) Interest will be compounded quarterly and credited in account and paid at the time of closure of account.

(iii) Account opened or deposit made in-contravention of rules will be eligible for interest @ PO Savings Account.

(d) Withdrawals in

Mahila Samman Savings Certificate (MSSC)

40% withdrawal of eligible balance can be taken after one year from the date of account opening.

(e) Pre-mature closure of

Mahila Samman Savings Certificate (MSSC)

(i) On the death of the account holder

(ii) On extreme compassionate ground (i) Life threatening decease, of account holder (ii) death of the guardian on production of relevant documents.

Note:-Scheme interest will be paid on principal amount

(iii) After six months of account opening without mentioning any reason.

Note:-Scheme interest less by 2 per cent will be paid e.g. 5.5%.

(f) Maturity of

Mahila Samman Savings Certificate (MSSC)

(i) After two years from the date opening eligible balance will be paid to the depositor.

(g) How to open

Mahila Samman Savings Certificate (MSSC) account

(i) Submit Account Opening Form, KYC Document (Aadhaar and PAN card) , KYC form for new account holder, Pay-in-Slip alongwith deposit amount/cheque at nearest post office.

India post is a best parcel shipping options

by

https://www.kitchenspices.in/